- English

- French

- German

- Portuguese

- Spanish

- Russian

- Japanese

- Korean

- Arabic

- Greek

- German

- Turkish

- Italian

- Danish

- Romanian

- Indonesian

- Czech

- Afrikaans

- Swedish

- Polish

- Basque

- Catalan

- Esperanto

- Hindi

- Lao

- Albanian

- Amharic

- Armenian

- Azerbaijani

- Belarusian

- Bengali

- Bosnian

- Bulgarian

- Cebuano

- Chichewa

- Corsican

- Croatian

- Dutch

- Estonian

- Filipino

- Finnish

- Frisian

- Galician

- Georgian

- Gujarati

- Haitian

- Hausa

- Hawaiian

- Hebrew

- Hmong

- Hungarian

- Icelandic

- Igbo

- Javanese

- Kannada

- Kazakh

- Khmer

- Kurdish

- Kyrgyz

- Latin

- Latvian

- Lithuanian

- Luxembou..

- Macedonian

- Malagasy

- Malay

- Malayalam

- Maltese

- Maori

- Marathi

- Mongolian

- Burmese

- Nepali

- Norwegian

- Pashto

- Persian

- Punjabi

- Serbian

- Sesotho

- Sinhala

- Slovak

- Slovenian

- Somali

- Samoan

- Scots Gaelic

- Shona

- Sindhi

- Sundanese

- Swahili

- Tajik

- Tamil

- Telugu

- Thai

- Ukrainian

- Urdu

- Uzbek

- Vietnamese

- Welsh

- Xhosa

- Yiddish

- Yoruba

- Zulu

The Economics of Automation: Calculating ROI for Lights-Out CNC Machining

One of the most important investment choices a machining business can make is to go to lights-out manufacturing. To figure out the ROI for unattended machining equipment and understand the economics of automation, you need to look at both direct and indirect costs in detail. This strategic investment includes more than just the cost of the equipment. It also includes savings on labor, more throughput, better quality, and a better position in the market. Manufacturers all over the world are finding that unattended machining capabilities save them money in ways that make the initial investment worth it. The issue is to appropriately weigh these benefits against the expenses of implementation so that you may make decisions that are in line with long-term business goals and market needs.

Understanding the True Costs of Lights-Out CNC Machining Implementation

Setting up unattended machining systems requires paying for more than just the cost of the equipment. CNC machines that can run for a long time, automated workpiece handling systems, tool management solutions, and quality inspection equipment are all part of the initial capital investment. But for projects to work, the facilities also need to be changed, such as better climate control, better electrical infrastructure, and better network access for remote monitoring. Investing in software for production planning, machine monitoring, and predictive maintenance can be quite useful, but you need to plan your money carefully. Training expenses are another important aspect because operators and technicians need to know a lot about how to develop, maintain, and debug automated systems. Infrastructure changes could include better chip removal systems, centralized coolant filtering, and automatic lubrication systems that make sure the system works reliably even when no one is there. Many facilities don't realize how much integration costs, which include system commissioning, workflow optimization, and process validation. Understanding these detailed cost structures lets you do accurate ROI estimates that show the real cost of implementing anything, not simply the cost of buying the equipment. Smart manufacturers make extensive cost models that include both evident and hidden costs. These models help them make accurate financial estimates that help them make decisions and get the money they need for automation projects.

Quantifying Direct Financial Benefits from Unattended Machining Operations

The most immediate financial benefits of unattended machining are lower labor costs and better use of machines. In a single shift, traditional staffed operations usually only use 40–50% of their spindles. However, lights-out manufacturing can use 70–85% of its spindles across numerous unmanned shifts. This huge rise in working hours leads to more output without a corresponding rise in labor expenditures. Labor savings go beyond just the salary of the people who do the machining. They also include lower costs for overtime, benefits, and staffing needs for night and weekend shifts. Also, unattended machining gets rid of regular productivity losses that happen during breaks, shift changes, and when people get tired, which are all normal parts of traditional operations. When manufacturers increase their production capacity, they may take on bigger orders or provide more products without having to build new facilities. This means they can make more money from the space they already have. Another measurable benefit is better quality, since automated systems keep process parameters the same, which lowers scrap rates and rework costs. Optimizing machine functioning and turning off lights in the building when no one is there can both save money and make energy use more efficient. When all of the direct benefits are added up, some facilities say that their per-part production costs go down by 30% to 40%. These real cash gains provide strong business cases that show obvious payback periods, which usually last between 18 and 36 months, depending on the size of the operation and how advanced the automation is.

Calculating Hidden Value and Indirect ROI Contributors

Unattended machining creates a lot of indirect value that has a big effect on overall ROI, but this value is frequently not evaluated. Competitive advantage is an important intangible benefit since lights-out capabilities allow for shorter lead times and more flexible scheduling, which draw in high-end customers and bigger contracts. The ability to promise and execute quicker turnaround times gives you pricing leverage that increases profit margins more than just cutting costs. Strategic value comes from reducing reliance on tight labor markets to lower risk, especially in areas where there aren't enough trained workers. Businesses that can automate their processes can keep making things even when their workers are sick, leave, or the economy is bad. Improvements in quality consistency make customers happier and lower warranty claims. This builds reputation value that leads to repeat business and referrals. Modern unattended machining systems can collect data on their own, which gives managers information that helps them make improvements all around the company. Automated monitoring can help find ways to improve processes that can lead to efficiency benefits in both manned and unmanned production. When automation gets rid of boring overnight shifts, employees are often happier, which leads to improved retention rates and lower hiring expenses. As skilled personnel spend less time tending to machines and more time on complicated programming and problem-solving, their ability to innovate grows. This speeds up efforts to enhance processes and develop new products. Optimizing resource use can help the environment and help businesses meet their sustainability goals. It may also make them eligible for green manufacturing subsidies. Smart manufacturers use these indirect value elements in entire ROI models that show the overall strategic impact of automation initiatives, instead of just looking at simple cost-benefit calculations.

Risk Assessment and Mitigation Strategies for Automation Investment

Every big investment of money comes with dangers that need to be well thought out and planned for. The main worry is that technology would become outdated too quickly, which could shorten the usable life of automated systems. But modular automation methods and systems that are built with upgrade paths can protect investments from changes in technology. Implementation complexity introduces hazards associated to lengthy downtime during installation and commissioning phases that can disrupt existing production and customer commitments. These transition risks are lower with phased deployment plans that automate certain cells or processes before expanding to the whole facility. If employees don't have the programming and troubleshooting skills needed for modern unattended machining systems, skills gaps in the current workforce could cause problems. These problems with human resources can be solved by offering comprehensive training programs and possibly recruiting automation experts strategically. When you go from attended operations, where people monitor and intervene in real time, to totally automated environments, you have to worry about process reliability. These operational hazards can be managed by strong process validation, long testing periods, and advanced monitoring systems with the right alert and shutdown procedures. If the expected benefits don't happen because of changes in the market or problems with implementation, the payback times could be longer than expected. Conservative ROI modeling with sensitivity analysis for key assumptions helps find possible financial weaknesses. When looking at overseas equipment providers, it's important to think about supply chain dependencies for specific automation parts or support services. Building ties with several vendors and keeping a stock of important spare components makes it less likely that supply problems would happen. Formal risk management frameworks that find possible problems early, put in place the right measures to deal with them, and make backup plans that protect investments no matter what unexpected problems come up during implementation or operation are all part of successful automation projects.

Building a Comprehensive ROI Model for Decision Making

Developing accurate ROI models requires systematic approaches that capture all relevant financial impacts while avoiding overly optimistic projections. Start with baseline performance metrics from current operations, including actual machine utilization rates, labor costs per part, quality metrics, and true capacity constraints. Define specific automation scenarios with detailed equipment specifications, expected performance improvements, and realistic implementation timelines. Calculate total cost of ownership over appropriate analysis periods, typically 5-7 years, incorporating equipment costs, installation expenses, training investments, maintenance requirements, and expected upgrade cycles. Project revenue impacts from increased capacity, improved quality, and potential pricing advantages enabled by unattended machining capabilities. Model labor cost savings conservatively, accounting for remaining supervision requirements and potential wage increases for skilled automation personnel. Include sensitivity analysis that tests ROI outcomes under various scenarios for key variables like utilization improvements, quality gains, and market demand changes. Incorporate time value of money through appropriate discount rates that reflect business cost of capital and investment risk profiles. Compare automation investment returns against alternative uses of capital to ensure projects compete favorably with other strategic initiatives. Develop clear decision criteria that define acceptable payback periods, minimum ROI thresholds, and strategic alignment factors beyond pure financial returns. Present findings with appropriate transparency about assumptions, uncertainties, and best-case versus conservative-case scenarios. Successful manufacturers view ROI analysis as an ongoing process rather than a one-time calculation, regularly updating models based on actual performance data and adjusting future automation strategies accordingly based on real-world results and evolving business needs.

Conclusion

The economics of lights-out manufacturing extend far beyond simple cost comparisons to encompass strategic competitive advantages and operational resilience. Comprehensive ROI analysis for unattended machining must account for direct savings, indirect benefits, implementation risks, and long-term strategic positioning. Organizations that approach automation investments with rigorous financial modeling and realistic expectations consistently achieve positive returns that strengthen market positions. Wuxi Kaihan Technology Co., Ltd. leverages extensive experience in precision CNC machining and automation to help manufacturers optimize their transition to lights-out operations, combining cost-effective solutions with reliable quality.

FAQs

1. What is the typical payback period for lights-out CNC machining systems?

Most manufacturers achieve payback periods between 18 and 36 months for unattended machining implementations, depending on operation scale, automation sophistication, and existing utilization rates. Facilities running multiple shifts see faster returns, while single-shift operations may experience longer payback timelines. Factors like labor costs, production volumes, and part complexity significantly influence these timeframes. Conservative financial planning should account for 24-30 months as a realistic expectation for most medium-scale implementations.

2. How does unattended machining impact overall equipment effectiveness?

Unattended machining dramatically improves overall equipment effectiveness (OEE) by increasing availability, performance, and quality metrics simultaneously. Typical implementations see availability increases from 50% to 75-85%, as machines operate during previously idle hours. Performance rates improve through optimized cutting parameters and elimination of human-paced cycle times. Quality benefits come from consistent process control and reduced variation, collectively pushing OEE from typical 40-60% ranges to 70-85% in well-executed lights-out operations.

3. What are the most critical success factors for automation ROI?

Critical success factors include thorough process validation before automation, comprehensive operator training, robust preventive maintenance programs, and realistic performance expectations. Organizations that succeed invest in proper infrastructure, implement phased rollout strategies, and maintain strong vendor partnerships. Data-driven decision making through continuous monitoring and systematic improvement processes separates successful implementations from disappointing ones. Management commitment and clear communication throughout the organization ensure alignment and resource availability.

4. How do market conditions affect automation investment decisions?

Market conditions significantly influence automation ROI through labor availability, competitive pressures, and demand volatility. Tight labor markets and rising wages accelerate payback periods, making unattended machining more attractive. Competitive industries where lead times drive customer decisions favor automation investments. However, uncertain demand environments may warrant delayed implementation until market visibility improves. Smart manufacturers balance current conditions against long-term strategic positioning when timing automation investments.

Partner with KHRV CNC Machining Solutions | Leading Unattended Machining Manufacturer

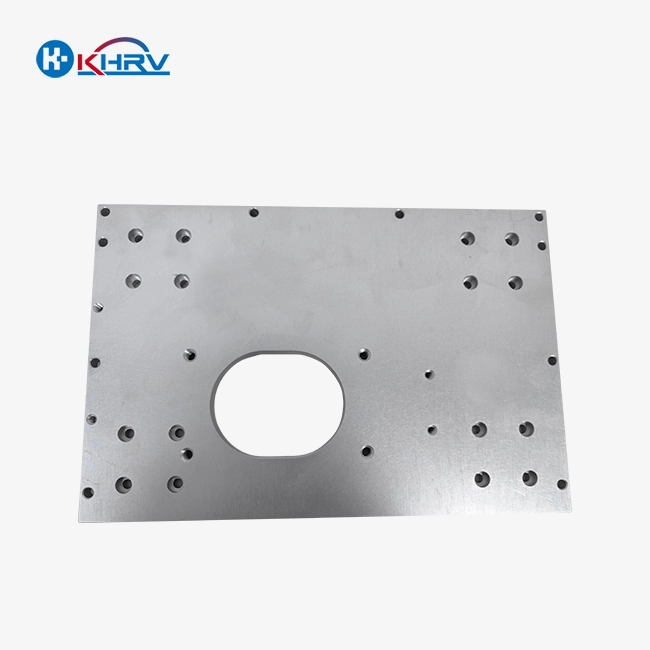

Wuxi Kaihan Technology Co., Ltd. stands as a high-tech enterprise specializing in R&D and production of key components for artificial intelligence equipment and automated precision machinery. Our team, comprising veterans from major international companies with deep expertise in precision CNC machining, mold design, and manufacturing, operates under a comprehensive ISO9001:2005 quality management system. We deliver competitive advantages through China's supply chain cost savings (30%-40% reduction), reliable product quality, and extensive industry experience. Our facility features 10 CNC machining centers, specialized EDM equipment, CNC lathes, and comprehensive machining capabilities that support both traditional and unattended machining operations. Our core services encompass OEM processing of precision machinery components, cross-border semi-finishing cost-saving solutions, precision multi-material processing, and cost-effective CNC tooling supply. Whether you're planning lights-out manufacturing implementation or seeking reliable precision machining partners, our engineering team provides expert guidance that optimizes your automation investment and maximizes ROI. Contact us at service@kaihancnc.com to discuss how our unattended machining capabilities and cost-effective solutions can strengthen your competitive position.

References

1. Smith, J. & Anderson, R. (2022). "Automation Economics in Modern Manufacturing: A Comprehensive ROI Framework." Journal of Manufacturing Systems, Vol. 64, pp. 234-248.

2. Thompson, M.K. et al. (2023). "Lights-Out Manufacturing: Performance Metrics and Financial Returns in CNC Machining Operations." International Journal of Production Economics, Vol. 257, pp. 108-122.

3. Weber, K.L. & Chen, H. (2022). "Strategic Investment Analysis for Automated Manufacturing Systems." Manufacturing Engineering Review, Vol. 45, No. 3, pp. 156-171.

4. Rodriguez, A.M. & Patel, S. (2023). "Risk Management in Manufacturing Automation: Financial and Operational Considerations." Industrial Management Journal, Vol. 78, No. 2, pp. 89-105.

5. Morrison, D.J. et al. (2022). "Calculating Total Cost of Ownership for Unattended Machining Centers: A Case Study Approach." Precision Engineering Quarterly, Vol. 39, No. 4, pp. 445-462.

6. Liu, Y. & Nakamura, T. (2023). "Competitive Advantages Through Manufacturing Automation: Quantifying Indirect Benefits." Global Manufacturing Strategy Review, Vol. 31, No. 1, pp. 67-84.

Learn about our latest products and discounts through SMS or email